How To Become A Quant | Carnegie Mellon University | Quantitative Finance Careers

How To Become A Quant

Are you a STEM student or professional looking to move into the lucrative and fascinating world of Quantitative Finance?

What are the pathways into further study? What compensation can one expect after graduation? How does a masters degree in quant finance or similar fields equate to other, similar MSc (Masters of Science) courses? In this article, we explain all these points and answer how you can become a Quant.

Industry Overview: Quantitative Finance and Analysis

A Quantitative Finance Analyst or simply “Quant” uses and analyzes large data sets through the use of novel or applied mathematical models to analyze financial markets and securities (stocks, bonds, derivatives, etc.)

These models comprise mathematical formulas by way of stochastic calculus, computer algorithms, machine learning modules, artificial intelligence, or combinations thereof.

Quantitative finance is a relatively new field of study and profession, helped along by the information technology boom of the late 20th Century (the 1980s onwards.) Advances in big data collection and analysis with the advent of faster processing power has allowed a flourishing of Quants in finance and risk management careers.

Growth In Quants

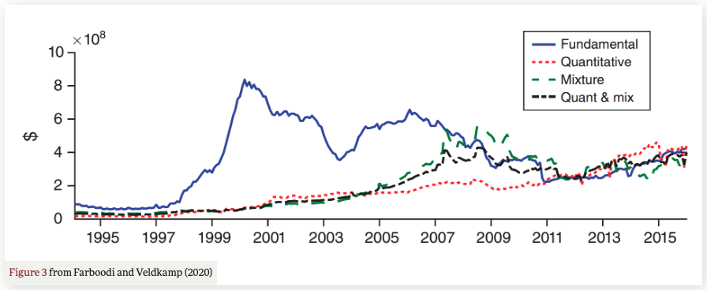

The American Economic Association data shows that quantitative analysis has skyrocketed over the past thirty years, leaving behind fundamental or “traditional” financial analysis - although a mix of fundamental and quantitative analysis is still used by many hedge funds and investment companies.

Another data point on the growth of Quants comes from Selby Jennings. They predict that the job market for quantitative analysts is anticipated to grow by nearly 10% through 2026. This includes over 54,000 new jobs to be filled by 2029 with cities like Chicago, Hong Kong, and Singapore leading this growth.

Let’s take a look at the top Quant roles within various industry employers.

Career Paths for Quants

Quants are in high demand in the financial analysis and stock broker/stock analyst sector in major trading hubs such as New York’s Wall Street, Chicago, and London.

Quants are not only limited to working as financial analysts. Quants are also found in risk management, securities trading, and asset management. Many Quants work for hedge funds, commercial banks, sophisticated investment houses, and insurance companies. Some Quants also work in academia or offer their own models to assist retail investors.

The main career pathways for Quants are:

-

Risk management: developing mathematical models to reduce or mitigate risk in trading, derivatives, or in the insurance industry.

-

Front office quant: These quants deal with sales and trading on a daily basis, tasked with identifying profitable opportunities through using quant strategies and formulae.

-

Quant research/analysis: using their skills to analyze current and historical trends to identify profitable trades or positions.

-

Algorithmic traders: Quants use their mathematics and computer programming skills to set up algorithms or machine learning models to execute trades to maximize profit and optimize client portfolios. These algorithms often trade thousands of times faster than humans. This requires computer programming skills (more on that in the next section.)

Critical Skills and Training for Quants

The primary skill a would-be Quant requires is an exceptional understanding and aptitude for mathematics. This means a thorough understanding and application of stochastic calculus; statistics and probability; applied mathematics; mathematics or physics-based computer programming languages such as Python, Java, R, C++, or MATLAB; and numerical analysis.

For example, quantitative financial formulas such as the Piotroski Score or F_SCORE is an algorithmic score using nine data points to evaluate the financial position of publicly traded companies on a scale of one to nine, using quantitative analysis of company financial data.

Determining formulas such as the F_SCORE requires high-level mathematics, calculus, and computer programming skills. These skills are also critical to construct algorithms.

Pricing securities and derivatives is a career unto itself, and these quants are known as “pricing quants” or “Q-measure quants” as they work according to a risk-neutral or “Q” measure.

Algorithms or formulas may be formulated to determine stock value, portfolio positions, target price forecasts, and assist stock brokers to optimize portfolio management.

With the advent of machine learning and artificial intelligence, Quants may also need to understand how to program these models or include them as a tool to help analyze large quantities of data in their daily workflow.

In addition to mathematics and computer programming, they also need a thorough understanding of financial markets and systems, such as securities, options, derivatives, swaps, etc. and what risks are involved with trading. This may also involve what’s known as trading and market microstructuring, “creating” new markets using data and statistical analysis.

The crux of a Quant’s work deals with data mining and data analysis to set up these algorithmic models. That means a Quant will need experience or expertise in using market data terminals such as Bloomberg Terminals or Thomson Reuters Terminals. These display useful market data in forms such as Bollinger bands; access to near-real time or real-time data to backtest algorithms and trading strategies; and automated access to market trading accounts or brokerage using Direct Market Access (DMA). They will need to recognize whether data is useful or not using backtesting - using historical data to qualify their trading strategy - and determine their next course of action based on their expert analysis. These trading Quants are also known as “P-measure quants.”

Validating these algorithms for regulatory compliance is also a career in Quant Finance, and these Quants are known as “model validation quants.” They are less involved in the day-to-day analysis and trading and usually work as a specialized type of back office support.

Validating these algorithms for regulatory compliance is also a career in Quant Finance, and these Quants are known as “model validation quants.” They are less involved in the day-to-day analysis and trading and usually work as a specialized type of back office support.

Other Quants who work in insurance may need to become familiar with the finer points of the insurance industry, such as policy coverage and limitation of liability.

Some trading or pricing quants may work with other quants who concentrate in programming, and these quants are known as quantitative developers.

Non-technical soft skills a Quant needs to succeed include interpersonal communication, presentation skills, working effectively on a team and emotional intelligence. Creativity and formulating novel algorithms are desirable; as are a “trader’s mindset” and appetite for risk; and a strategic investment outlook that takes into account the long-term growth of a portfolio when making tactical decisions

Entry Paths into Quantitative Finance

Though the “traditional” entry point into Quantitative Finance is through mathematics or similar degrees, one may enter the field as a postgraduate if they arrive from a mathematics or physics-based academic background such as engineering or computer science Bachelor’s degree.

There are also entry points into Quantitative Finance from a traditional finance or economics pathway, provided the prospective Quant can demonstrate a thorough understanding of mathematics and computer programming.

A Chartered Financial Analyst who undertakes further professional development in data science or Fintech (financial technology) may also see this as an entry point into quantitative finance.

Medium to large firms will only seriously consider prospective Quants with a Master’s degree or equivalent, or further education such as a Ph.D. They may also consider CFAs as candidates. This is due to the highly complex nature of Quant work.

Certificate/Diploma

Though a certificate or undergraduate diploma is not sufficient to cover the breadth and depth of mathematical knowledge required to be a Quant, it can be an entry point into Bachelor or Masters’ level courses. Pathways into further education may include the Diploma of Accounting or Diploma of Automated Building Systems. Graduate Certificates in Financial Markets and Institutions, or Business Analytics may also be a stepping stone toward gaining a foothold in the principles of Quant mathematics. Post-graduate degrees are also available, such as the Certificate of Quantitative Finance.

Bachelor’s Degrees

The most common bachelors’ degrees leading to further study into Quantitative Finance are degrees with majors in mathematics, statistics, engineering, or computer science. These are distinct from Mathematics Education BA/BSc courses, which are focused on primary or secondary education.

These degrees will give candidates the fundamentals in what underpins algorithms and statistical analysis, probabilities and statistical functions, computer programming, and high-level stochastic calculus and applied mathematics.

Master’s degrees

There are several Master’s degrees with concentrations in computational finance, applied mathematics, and other computer or physics related fields that lead directly into a Quant career. Read more on this below.

Ph.D./Post-Doctorates

Some Masters or post-graduate certificate holders may be eligible for further concentrated study in Quantitative Finance through a Ph.D. via dissertation and further post-doctoral study in their chosen field. This varies from university to university.

Masters Degrees in Quantitative Finance

In the United States, there are several Masters-level programs that directly lead into quantitative finance careers. According to QuantNet, there are 23 such rated programs ranging from a Master of Finance, Master of Science in Computational Finance, Master of Financial Engineering, Master of Mathematics in Finance, or variations thereof.

Top Program Requirements

The top programs will require prospective students to have a Bachelors’ or equivalent degree in mathematics, statistics, computer science and/or applied finance to be considered for a Masters program.

You will also need to prove English proficiency either by academic transcript showing at least two years of your Bachelor’s degree was primarily delivered in English, or taking a Duolingo, TOEFL or IELTS exam.

Masters programs will require a valid and official GRE or GMAT score - though ranking by schools vary, a score of 159-163 in Verbal and a score of 165-170 in Quantitative may be required for entry into Masters of Financial Engineering or equivalent course.

Pre-requisite courses may include:

- Linear Algebra

- Calculus I and II

- Calculus based probability

- Statistics or stochastic calculus

- At least one semester’s worth of

Computer Programming (Java, Python, C++)

Some colleges may evaluate your application on a case by case basis, and accept students that undergo remedial courses in the absence of prior learning.

Schools may also ask for essays outlining your desire to work in Quantitative Finance, resumes, recorded video essays, and in-person interviews.

Evaluating MSc Degrees

Masters of Science (MSc) degrees all have varying scope of learning and concentrations. For example, a pure mathematics program may sacrifice crucial real-world Quant applications to concentrate on theory.

Prospective students should look for a well-rounded program that includes mathematics, computer programming, financial technology, and business studies. They should also ask whether the curriculum is routinely updated to include new innovations in Quant finance, such as the application of AI and ML in risk management or algo trading.

A balance of tenured professors and subject matter experts also offer a bridge between theory and practice, which employers find more valuable.

A university offering robust career services and high post-graduate employment statistics should also be a factor in choosing a MSc program - the added costs involved may be a wise investment.

Carnegie Mellon University’s Master of Science in Computational Finance is one of the premier avenues into the dynamic and lucrative world of Quantitative finance. For 30 years, they've prepared students for highly successful careers in Quantitative finance. The outcomes-focused interdisciplinary curriculum and blend of tenured faculty and subject matter experts have led to a 100% graduate hire rate with a median base salary of $140,000 not including sign-on and year-end bonuses.

Learn more about MSCF alumni salary statistics, shifts in buy side and sell side employment, job promotion data, and the most important skills for future quantitative finance success by downloading our alumni career report.